Business Insurance in and around Saint Louis

Saint Louis! Look no further for small business insurance.

This small business insurance is not risky

Help Prepare Your Business For The Unexpected.

Whether you own a an antique store, a confectionary, or a HVAC company, State Farm has small business coverage that can help. That way, amid all the various decisions and moving pieces, you can focus on making this adventure a success.

Saint Louis! Look no further for small business insurance.

This small business insurance is not risky

Strictly Business With State Farm

You are dedicated to your small business like State Farm is dedicated to reliable insurance. That's why it only makes sense to check out their coverage offerings for artisan and service contractors, commercial auto or commercial liability umbrella policies.

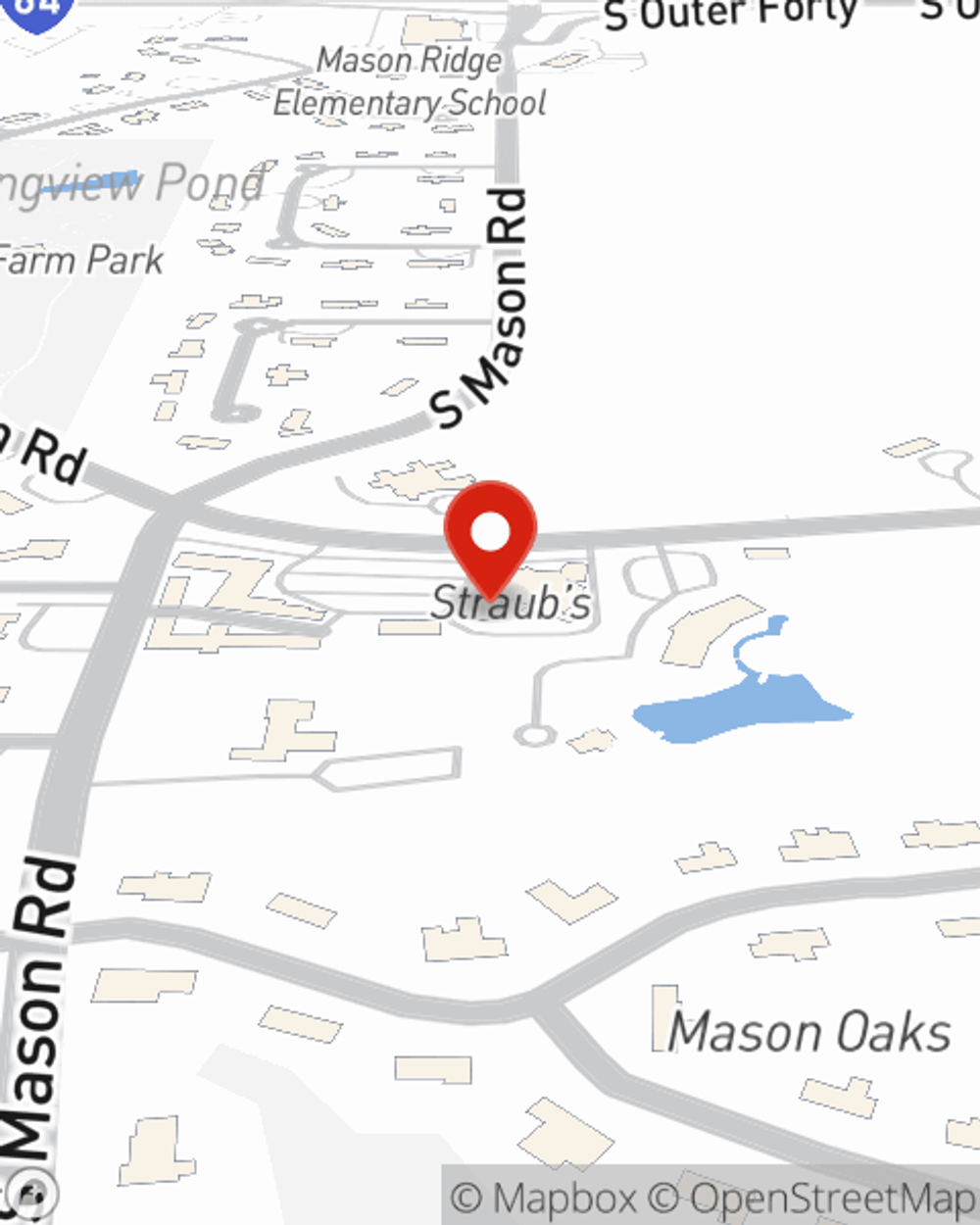

The right coverages can help keep your business safe. Consider stopping by State Farm agent Wesley Ranew's office today to identify your options and get started!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Wesley Ranew

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.